The Facebook IPO gets closer and I don’t think I can put off this valuation much longer. While we don’t have an offering price yet, the preliminary estimates are that the company will be valued somewhere between $75 billion and $100 billion. As with my Skype, Linkedin and Groupon valuations, I will present my assumptions and valuation of Facebook, with the admission that I have no crystal ball and know that your estimates will be very different from mine. So, with that disclaimer out of the way, here are my valuation assumptions for Facebook.

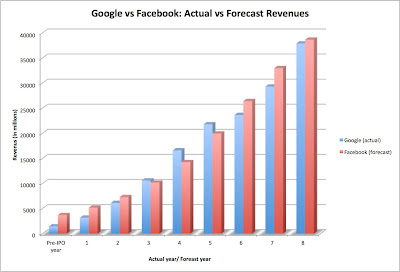

2. Future revenues: Facebook is on a "high growth" path, with revenues growing by 150% in 2010 and another 88% in 2011, but as even that sample of two observations suggests, the big question is how that growth rate will hold up as the firm becomes larger. I estimate a compounded revenue growth rate of 40% for the next five years and a scaling down of that growth rate to the nominal growth rate in the economy (set equal to the risk free rate of 2.01%) by the end of ten years. While both assumptions may strike you as conservative, I am effectively assuming that Facebook will follow a revenue growth path close to Google's over the next 8 years, as evidenced in the chart below, where I compare Google's actual revenues in the 8 years since their IPO with Facebook's forecasted revenues for the next 8 years:

Since advertising revenues are the drivers of both firms' growth engines, and they may very well be competing for the same advertising dollars, I think a comparison of their competitive advantages is in order. Facebook's primary advantage is that they can use what they know about their users (which is a lot... scary thought!) to offer focused advertising. Google's advantage is that it has a more direct and easy business model, since its revenues come from user clicks. In contrast, Facebook has to be careful about making its focused advertising too obvious, since some users will find this creepy. Google has added other products to its mix, with the Android as the most prominent example, and Facebook also has potential avenues for expansion.

3. Operating margin: Facebook has a phenomenal pre-tax operating profit margin in excess of 45%. To provide a contrast, Google's operating margin is currently about 31% and has seldom exceeded 35%. However, Facebook's margins will come under pressure as they actively seek out more revenues and I am assuming that the pre-tax margin will decrease to 35% over the next decade. Even with this assumption, I am estimating operating income for Facebook will exceed Google's by a wide margin over the 8 years following the IPO:

For those of you who are familiar with my valuations of Linkedin and Groupon, you will note that I am more positive about Facebook than those companies. Part of that can be attributed to Facebook being further along in developing a business model that works and delivers profits. Another reason, though, is that Facebook has a real chance at being the next “winner take all” company. What am I talking about? In conventional businesses, a company that gets a large portion of the market is subject to competitive assaults that cap the market share and reduce profitability over time. In some parts of the technology business, controlling a large share of a market seems to give the winner the capacity to take over the whole market. Consider three big winners from the last 30 years. Microsoft started off in the “office suites’ competing with many players in the word processing, spreadsheet and presentation program businesses, but at some point, its dominance drove the competition out. To a lesser extent, Amazon’s dominance of online retailing and Google’s ownership of online advertising (so far) reflect similar “winner take all” phenomena. I am not suggesting that Facebook has a lock on social media advertising, but it has a chance to get a big chunk of it, and if it does, the value that I estimated will be too low. Note that the simulation does yield values of $120 billion or higher for the company, if the stars align.

Would I buy Facebook stock, if its equity were valued at $75 billion? No, and not because I believe that the price is outlandish, but for two other reasons.

1. Where Facebook stands right now: I started with the Facebook S-1 filing which contains their financials from last year. The pdf version is available here, with my highlights and annotations (just ignore my snarky comments... I cannot help them). Looking at the most recent year's numbers, here is what I see:

(a) Revenues in 2011 were $3,711 million, up 88% from revenues of $1,974 million in 2010, which, in turn, were up 150% from revenue of $777 million in 2009.

(b) The firm's pre-tax operating income increased from $1,032 million in 2010 to $1,756 million in 2011. The firm's net income increased from $ 606 million in 2010 to $ 1 billion in 2011, though a third of that net income was set aside for participating securities (convertible preferred and restricted stock units... More on that later...). Incidentally, Facebook paid 41% of its taxable income as taxes in 2011.

(c) The company is primarily equity funded and its book value of equity at the end of 2011 was $5,228 million; the only debt on the books was $398 million in capital leases. They did have operating lease commitments, which when capitalized yielded a value of $776 million. The total debt is therefor $1,174 million.

(a) Revenues in 2011 were $3,711 million, up 88% from revenues of $1,974 million in 2010, which, in turn, were up 150% from revenue of $777 million in 2009.

(b) The firm's pre-tax operating income increased from $1,032 million in 2010 to $1,756 million in 2011. The firm's net income increased from $ 606 million in 2010 to $ 1 billion in 2011, though a third of that net income was set aside for participating securities (convertible preferred and restricted stock units... More on that later...). Incidentally, Facebook paid 41% of its taxable income as taxes in 2011.

(c) The company is primarily equity funded and its book value of equity at the end of 2011 was $5,228 million; the only debt on the books was $398 million in capital leases. They did have operating lease commitments, which when capitalized yielded a value of $776 million. The total debt is therefor $1,174 million.

2. Future revenues: Facebook is on a "high growth" path, with revenues growing by 150% in 2010 and another 88% in 2011, but as even that sample of two observations suggests, the big question is how that growth rate will hold up as the firm becomes larger. I estimate a compounded revenue growth rate of 40% for the next five years and a scaling down of that growth rate to the nominal growth rate in the economy (set equal to the risk free rate of 2.01%) by the end of ten years. While both assumptions may strike you as conservative, I am effectively assuming that Facebook will follow a revenue growth path close to Google's over the next 8 years, as evidenced in the chart below, where I compare Google's actual revenues in the 8 years since their IPO with Facebook's forecasted revenues for the next 8 years:

Since advertising revenues are the drivers of both firms' growth engines, and they may very well be competing for the same advertising dollars, I think a comparison of their competitive advantages is in order. Facebook's primary advantage is that they can use what they know about their users (which is a lot... scary thought!) to offer focused advertising. Google's advantage is that it has a more direct and easy business model, since its revenues come from user clicks. In contrast, Facebook has to be careful about making its focused advertising too obvious, since some users will find this creepy. Google has added other products to its mix, with the Android as the most prominent example, and Facebook also has potential avenues for expansion.

3. Operating margin: Facebook has a phenomenal pre-tax operating profit margin in excess of 45%. To provide a contrast, Google's operating margin is currently about 31% and has seldom exceeded 35%. However, Facebook's margins will come under pressure as they actively seek out more revenues and I am assuming that the pre-tax margin will decrease to 35% over the next decade. Even with this assumption, I am estimating operating income for Facebook will exceed Google's by a wide margin over the 8 years following the IPO:

4. Reinvestment: In one of a series of posts on growth, I argued that growth does not come free (or even cheap). That is true for even a company with the pedigree of Facebook. There is some information in the financial statements about reinvestment: the company had net capital expenditures of $ 283 million, an acquisition that cost $24 million and an increase in capital leases of about $ 480 million. To estimate reinvestment in future years, I assumed that the firm would be able to generate about $1.5 million in revenues for every million in additional capital investment. At this stage, it is impossible to tell what form the reinvestment may take, but looking at Google over the last few years should provide clues; the company has moved increasingly to using acquisitions to augment growth. Lest you feel that I am being too conservative, I am estimating that Facebook will generate a return on its capital of about 32% in year 10, up from just over 26% now.

5. Risk and cost of capital: Facebook is a company that is funded almost entirely with equity and while it is a young, growth company, it does have a business model that is working and delivering substantial profits. While we can start from the bottom and work up to a cost of capital, using parameters estimated for Facebook, I will employ a far simpler approach. Looking across the costs of capital of all US companies at the start of 2012 (you can find this on my website), I estimate a cost of capital of 11.42% for advertising companies. I will assume that Facebook will face a similar cost of capital to start. The median cost of capital for US companies is roughly 8% and as Facebook grows and matures, I do adjust the cost of capital down to 8%.

6. Cash and Debt: The assumptions above are sufficient to estimate the value of the operating assets. Discounting the cash flows back at the cost of capital (with changes over time) results in a value of $71,240 million. To get to equity value, I subtract out the outstanding debt ($1,174 million) and add the current cash balance ($1,512 million). While I would normally augment the cash balance with any cash proceeds from the IPO, Facebook is open about the fact (See S1, page 7) that the proceeds will be going to Mark Zuckerberg to cover tax expenses from option exercise and will not be coming to the firm.

Value of equity = $71,240 + $1,512 - $1,174 = $71,578 million

Based on my estimates, the values being bandied around ($75 billion- $ 100 billion) are not unreasonable. As with my Groupon valuation, I ran a simulation,making assumptions about distributions for my key assumptions (revenue growth, operating margin, cost of capital and reinvestment). The results are summarized below:

Note that the median value of $ 70 billion is close to the base case estimate (as it should) but there is a 10% chance that the value could be greater than $ 117 billion and a 10% chance of a value of $ 43 billion or less.

Note that the median value of $ 70 billion is close to the base case estimate (as it should) but there is a 10% chance that the value could be greater than $ 117 billion and a 10% chance of a value of $ 43 billion or less.

7. Value per share: At some stage in this IPO process, Facebook's investment bankers will have to arrive at a value per share (offered) and you and I will have to decide on whether to buy or not. That could be messy because Facebook has multiple claims on equity, starting with:

a. Equity options: There are 138.54 million options outstanding, from earlier year compensation schemes, with an average maturity of about 2 years and an exercise price of $0.75. My estimate of the value of these options collectively, net of the tax benefits that I see Facebook getting from the exercise, is $3,782 million. I will net this value out against the equity value to get to a value in the shares:

Value in shares = $71,578 million - $3,782 million = $67,795 million

b. Restricted Stock Units: In the last few years, Facebook (like many other tech companies) has shifted to granting restricted stock units. These are regular shares but the holders who receive have to first stay long enough with the company (vest) to lay claim to them and often face restrictions on trading. The liquidity restrictions, in particular, should make these shares less valuable than regular shares. There are 380.719 millions class B shares, in restricted stock units, that will eventually become regular shares and I will add them to current shards outstanding.

c. Class A and Class B shares: After the IPO, there will be 117.097 million Class A shares (with one voting right per share) and 1758.902 million Class B shares (with ten voting rights per share). Other things remaining equal, the latter should trade at a premium on the former, though I don't think that the expected value of control in this company is significant.

If I take the equity value, net of the value of options, and divide by the total number of class A, class B and RSU shares outstanding, the value per share that I get is $29.05. Allowing for a slight discount (3-5%) on the non-voting shares, I would anticipate that the class A shares in the IPO will have a value of about $28 (assuming that my share count is right... I will wait to get a firmer update as we get closer to the offering, before I close in on a per share value). You can access the excel spreadsheet with the numbers by clicking here. If you don't like my inputs or assumptions, don't stew about them. Go in and change them and see what you get as the aggregate value of equity in Facebook. If you can post it in the Google spreadsheet that I have created for this purpose, even better... Let's see if we can get a consensus value for the company.

If you are investing in Facebook, give credit to the company for being upfront and honest about where the power rests in this company. On page 20 of the filing, you will find this "Mr. Zuckerberg has the ability to control the outcome of matters submitted to our stockholders for approval, including the election of directors and any merger, consolidation, or sale of all or substantially all of our assets. In addition, Mr. Zuckerberg has the ability to control the management and affairs of our company as a result of his position as our CEO and his ability to control the election of our directors. Additionally, in the event that Mr. Zuckerberg controls our company at the time of his death, control may be transferred to a person or entity that he designates as his successor." A little later on page 31, you will find this "We have elected to take advantage of the “controlled company” exemption to the corporate governance rules for publicly listed companies. Because we qualify as a “controlled company” under the corporate governance rules for publicly-listed companies, we are not required to have a majority of our board of directors be independent, nor are we required to have a compensation committee or an independent nominating function." Let's be clear about this: this is Mark Zuckerberg's company and you and I are just providing him with capital.

If I take the equity value, net of the value of options, and divide by the total number of class A, class B and RSU shares outstanding, the value per share that I get is $29.05. Allowing for a slight discount (3-5%) on the non-voting shares, I would anticipate that the class A shares in the IPO will have a value of about $28 (assuming that my share count is right... I will wait to get a firmer update as we get closer to the offering, before I close in on a per share value). You can access the excel spreadsheet with the numbers by clicking here. If you don't like my inputs or assumptions, don't stew about them. Go in and change them and see what you get as the aggregate value of equity in Facebook. If you can post it in the Google spreadsheet that I have created for this purpose, even better... Let's see if we can get a consensus value for the company.

If you are investing in Facebook, give credit to the company for being upfront and honest about where the power rests in this company. On page 20 of the filing, you will find this "Mr. Zuckerberg has the ability to control the outcome of matters submitted to our stockholders for approval, including the election of directors and any merger, consolidation, or sale of all or substantially all of our assets. In addition, Mr. Zuckerberg has the ability to control the management and affairs of our company as a result of his position as our CEO and his ability to control the election of our directors. Additionally, in the event that Mr. Zuckerberg controls our company at the time of his death, control may be transferred to a person or entity that he designates as his successor." A little later on page 31, you will find this "We have elected to take advantage of the “controlled company” exemption to the corporate governance rules for publicly listed companies. Because we qualify as a “controlled company” under the corporate governance rules for publicly-listed companies, we are not required to have a majority of our board of directors be independent, nor are we required to have a compensation committee or an independent nominating function." Let's be clear about this: this is Mark Zuckerberg's company and you and I are just providing him with capital.

For those of you who are familiar with my valuations of Linkedin and Groupon, you will note that I am more positive about Facebook than those companies. Part of that can be attributed to Facebook being further along in developing a business model that works and delivers profits. Another reason, though, is that Facebook has a real chance at being the next “winner take all” company. What am I talking about? In conventional businesses, a company that gets a large portion of the market is subject to competitive assaults that cap the market share and reduce profitability over time. In some parts of the technology business, controlling a large share of a market seems to give the winner the capacity to take over the whole market. Consider three big winners from the last 30 years. Microsoft started off in the “office suites’ competing with many players in the word processing, spreadsheet and presentation program businesses, but at some point, its dominance drove the competition out. To a lesser extent, Amazon’s dominance of online retailing and Google’s ownership of online advertising (so far) reflect similar “winner take all” phenomena. I am not suggesting that Facebook has a lock on social media advertising, but it has a chance to get a big chunk of it, and if it does, the value that I estimated will be too low. Note that the simulation does yield values of $120 billion or higher for the company, if the stars align.

Would I buy Facebook stock, if its equity were valued at $75 billion? No, and not because I believe that the price is outlandish, but for two other reasons.

- The first is that the price reflects the expectation that Facebook will become a phenomenal success. Anything less than superlative will be viewed as a failure.

- The second is that what Facebook is brazen about the fact that they don't see any need for input from stockholders. In effect, they want my money but don't want me to have any say in how the company is run. This does not jell with the notion that stockholders are part owners of the companies that they owned stock in. You may be comfortable with Zuckerberg as CEO for life but I am not. I am sure that I am in the minority on this one, but different strokes for different folks....

0 comments:

Post a Comment